From the Inquirer: Two influential government officials — a senator with a strong anticrime advocacy and the country’s top financial regulator — want incoming lawmakers to make it easier for authorities to examine bank deposits for evidence of potential wrongdoing.

Related: Lacson Bill Removes Bank Secrecy Act Protection for Gov’t Officials, Employees

Revisions to deposit secrecy law may yet see the light

By: Daxim L. Lucas – Reporter / @daxinq

Philippine Daily Inquirer / 05:09 AM July 22, 2019

“All deposits of whatever nature with banks or banking institutions in the Philippines including investments in bonds issued by the government of the Philippines, its political subdivisions and its instrumentalities, are hereby considered as of an absolutely confidential nature and may not be examined, inquired or looked into by any person, government official, bureau or office, except upon written permission of the depositor, or in cases of impeachment, or upon order of a competent court in cases of bribery or dereliction of duty of public officials, or in cases where the money deposited or invested is the subject matter of the litigation.”

Thus states the second of only six sections of the country’s deposit secrecy law, which has remained in force today as Republic Act No. 1405 since its enactment almost 64 years ago on Sept. 9, 1955.

And though many subsequent laws like the Anti-Money Laundering Act and the charters of the central bank and the government deposit insurer have chipped away at this statute over the years, the Philippines remains one of the most restrictive places in the world when it comes to probing the proceeds of illegal acts lodged in the financial system.

But that may be about to change.

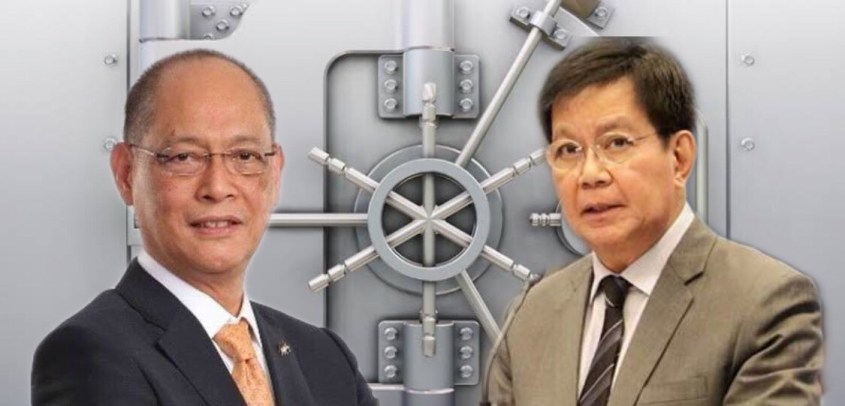

Two influential government officials — a senator with a strong anticrime advocacy and the country’s top financial regulator — want incoming lawmakers to make it easier for authorities to examine bank deposits for evidence of potential wrongdoing.

In particular, Sen. Panfilo Lacson wants a law that will exempt public officials from the protective ambit of the bank secrecy law.

The former national police chief recently filed Senate Bill No. 26 seeking to strip government officials and employees of the bank secrecy protection, noting that these restrictions had frequently been exploited in the past to “hamper and stall investigations” of official wrongdoing.

If it passes, it will make it easier to probe “all depositors who are elective or appointive officials or employees of the government, from the President to the lowest-ranking employee.”

The bill also covers members of the uniformed services and government-owned and -controlled corporations.

Lacson has tried to push for this law before but, to no one’s surprise, failed to get the support of fellow lawmakers.

This time around, however, his proposal jibes with the legislative wish list of a key member of the Duterte administration’s economic team—a potential game changer.

“We need this for transparency and our anticorruption efforts,” Bangko Sentral ng Pilipinas Governor Benjamin Diokno said of the regulator’s push for the new Congress to ease the country’s archaic deposit secrecy law.

“It’s important that we adhere to international best practices,” he said when asked about the rationale for wanting greater powers to examine bank deposits for potential wrongdoing. “There are only two countries in the world, I understand, that still have [absolute deposit secrecy]: us and an African country.”

At present, the Philippines has several laws that grant authorities varying degrees of access to bank deposit information, including the Anti-Money Laundering Act, the charter of the Bangko Sentral ng Pilipinas and the charter of Philippine Deposit Insurance Corp. But the process is cumbersome and can easily be deterred by legal maneuvers like court injunctions.

Diokno believes this perception makes the financial system a safe haven for the financial proceeds of illegal activities, both here and abroad.

“Those who would like to hide their dirty money come to us,” he said. “We attract the bad guys.”

The central bank chief said empirical data were not available to determine the magnitude of this problem, precisely because secrecy provisions of the law make it difficult to gather more information, but stressed that transparency in government was one thrust that policymakers are pushing for.

Indeed, this proposal for a relaxed bank secrecy law—especially the proposal to exempt government officials from its protection—has even received the backing of administration critics.

Recently, human rights lawyer Chel Diokno backed Lacson’s proposed bill.

“Our bank secrecy laws are among the strictest in the world,” he said. “If government officials are exempted, it would be easier to investigate corruption in the bureaucracy.”

“We should support this proposal of Senator Lacson,” he added. “This is a good step toward transparency.”

So far, no one has yet forcefully raised the old argument of potential government abuse of this power to examine bank deposits as a foil for this proposal, but it will likely emerge once lawmakers start to deliberate on the bill.

Chel Diokno said he would leave it up to Congress to put the required safeguards to deter potential abuses of this power but stressed that the fear of possible government harassment and persecution should not stop this move toward bringing financial laws in line with the rest of the world.

“You can’t say ’we cannot do it because we don’t trust the government,’” he said. “You have to trust the government.”